S-K-I Ltd.

New England Ski Presence: 1984-1996

After over a quarter of a century of successful financial performance, Sherburne Corporation found itself in a standoff with the State of Vermont in the 1980s, as proposed investments where being blocked due to growing environmental regulation. Unable to continue to invest as it wanted to in its existing areas, Killington and Mt. Snow, the owners of Sherburne Corporation looked to grow by acquisition.

Pres Smith at Sunrise in 1985

S-K-I Ltd. (Sherburne-Killington-Investments) was formed as a Delaware corporation in the fall of 1984. Preston Leete Smith, founder of Killington, served as Chief Executive Officer and Chairman of the Board, as 500,000 new shares of stock were issued via a fall 1985 IPO. Not surprisingly, the company decided not to make any capital investments in Killington during that 1985 off season, due to the bureaucratic roadblocks.

S-K-I Ltd.'s first acquisition took place on April 28, 1986, when Carinthia was acquired and subsequently connected to Mt. Snow. Fiscal year 1986 resulted in $56.5 million in revenue and a profit of $3.5 million, which grew to $66.1 million and $4.4 million in 1987, respectively. The company's first three high speed quads were installed for the 1987-88 season. Meanwhile, sights were being set on a western expansion.

Bear Mountain

After years of talks, S-K-I Ltd. purchased Goldmine ski area (originally known as Moonridge) in Southern California in early 1988 for $10 million. Commenting on the sale in January 1988, Pres Smith stated, "it's a terrific resort, it just needs updating." S-K-I's Larry Jensen commented, "Maybe we paid more than it's worth, but not more than it's going to be worth."

Renaming the area Bear Mountain, $9 million was invested in snowmaking, lifts improvements, and financial systems for the 1988-89 season, taking aim at Mammoth Mountain's market share. For the fiscal year ending July 31, 1988, S-K-I Ltd. recorded a company-wide profit of $5.2 million on $76.1 million of revenue.

With the addition of Bear Mountain, by 1989, S-K-I Ltd. owned three ski areas and 6,400 acres of land and was looking to continue to grow. In summer 1989, plans to merge Pico with Killington were announced, with an expected deal completion at the end of the year. While the merger did not close, Killington managed Pico for the 1989-90 and 1990-91 seasons. While 1989 revenues were boosted to $82 million with the Bear Mountain acquisition, profits slipped to $4.6 million. Heading into a recession, S-K-I saw revenues grow to $84.6 million in 1990, then slip to $83 million in 1991, while its profit dropped to $3.6 million in 1990 and $3.4 million in 1991. Continuing to look into ski areas adjacent to its holdings, in 1991 S-K-I Ltd. entered into a 3 year lease to operate Mount Snow's neighbor, Haystack.

As the country emerged from the early 1990s recession, a spending spree emerged in the ski industry.

S-K-I Ltd. was no stranger to this trend, as, according to Killington: A Story of Mountains and Men, it researched up to 20 ski areas a year for possible acquisition, including western resorts such as Alpine Meadows, Breckenridge, Steamboat, and Wolf Mountain, as well as possibly partnering with MSSI to acquire Mont Sainte-Anne in Quebec.

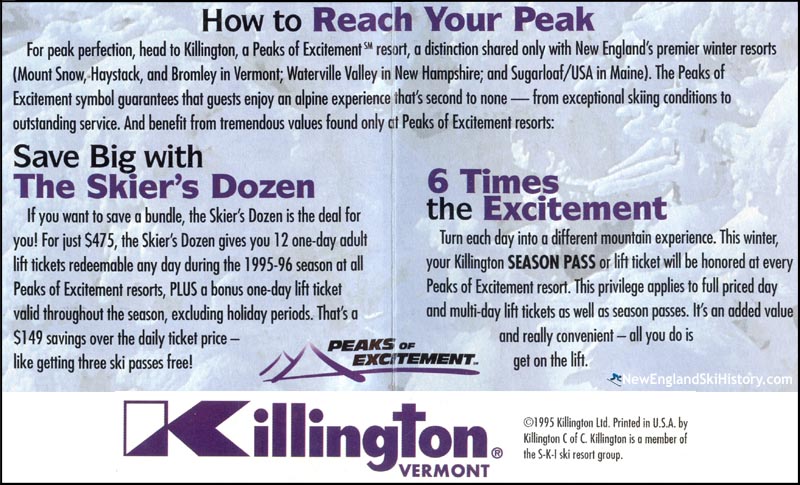

S-K-I Ltd. made its next move in 1994, when it quickly added three more areas to its ranks. In June of that year, S-K-I Ltd. exercised the option associated with its lease when it purchased Haystack for $4.5 million. Soon thereafter, S-K-I entered into a marketing agreement with Bromley, as it explored a possible acquisition of the Vermont area.

On August 24, 1994, S-K-I Ltd. acquired 51% of the outstanding shares of capital stock of Sugarloaf Mountain Corporation for Sugarloaf, ME. The acquisition put it up against LBO Resort Enterprises in the Maine market. S-K-I's investment in the resort resulted in the installation of its signature SuperQuad lift.

On October 31, 1994, S-K-I Ltd. purchased the assets of Waterville Valley, NH from the Waterville Company, Inc. for $10,037,631. The acquisition took place just months after LBO Resort Enterprises had entered the New Hampshire market by acquiring Attitash. With the new portfolio of areas, S-K-I Ltd. created multi-area offerings including blocks of tickets and season passes valid across its Northeast holdings.

In addition to the acquisitions, S-K-I also made a significant investment in Killington when it replaced the original gondola. The new Skyeship cost an estimated $15,000,000.

1995-96 S-K-I Ltd. Deals

Fiscal year 1995 profits slipped to $1 million on record gross revenues of $114 million, $101 million of which came from its New England ski areas. At this point, according to Pres Smith, "about 1994-5 my management team and I concluded that given ski industry circumstances and perceived resort values that we would likely see short to medium term growth as unrewarding and below par for our stockholders. We concluded that selling out for cash would be the prudent route."

In September 1995, S-K-I started negotiations for the sale of Bear Mountain. On October 23, 1995, S-K-I Ltd. sold Bear Mountain to Fibreboard Corp. for $20,500,000, using the funds to pay down debt, while also recognizing a loss of $4.2 million.

On February 13, 1996, the Board of Directors of S-K-I Ltd. recommended a $104.6 million (plus $58.5 million of debt assumption) merger offer from LBO Resort Enterprises Corp. The shareholders of S-K-I Ltd. approved the offer on June 10, 1996. The following day, the United States Justice Department ordered the new company to sell Cranmore and Waterville Valley due to anti-trust concerns.

According to Pres Smith, "The lawyers decided that the first step in designing the buyout structure would be to have a preliminary merger (two-thirds vote). This step would bring 100% cash over to S-K-I after which we would distribute that to stockholders. When the ink dried LBO had a bundle of assets but there was no longer

an S-K-I Ltd. nor any S-K-I Management to merge with."

On June 28, 1996, the deal between LBO Resort Enterprises Corp. and S-K-I Ltd. formally closed, resulting in the formation of American Skiing Company. Leslie B. Otten of LBO became President and Chief Executive Officer of the new company, while many of S-K-I Ltd.'s key figures moved on or retired.

S-K-I Ltd. Resources on NewEnglandSkiHistory.com:

Preston Smith Biography

Bromley

Carinthia

Haystack

Killington

Mt. Snow

Sugarloaf

Waterville Valley

S-K-I Ltd. External Links:

Last updated: September 21, 2018

|